Last week both AMD and Facebook released financial results. The one similarity I see between the two companies is that their stocks are undervalued.

AMD got there by massively overachieving expectations, while Facebook got there by blowing out costs and tanking growth, causing the stock to drop by over 25 percent. Mark Zuckerberg is estimated to have lost more in one day than most of you reading this, collectively, will make in your lifetimes.

Facebook is suddenly starting to look a lot like Netscape did many years ago, and that isn’t a good thing. The cause appears to be the same: inexperienced leadership.

Meanwhile, AMD is doing exceedingly well because it aggressively pursued experienced leaders. The difference this quarter in year-over-year performance between the two companies proves the advantages of veteran leadership.

Let’s compare AMD and Facebook this week. Then, we’ll close with my product of the week: an electric truck which also currently exceeds all expectations.

Contrasting Companies

AMD and Facebook are not remotely similar.

AMD designs and builds microprocessors. That market this past year was plagued with logistics problems which makes the company’s outstanding performance even more amazing. Against massive performance headwinds, AMD still blew out the numbers.

Facebook, which has been renamed Meta but is still largely known as Facebook (because it hasn’t really bothered to execute its renaming well, either), is in the social media business and dominates that space. Its headwinds were self-created through a series of badly thought through decisions that put its users at risk and put the company on the shortlist of firms likely to be broken up or fined to the bone by a variety of governments.

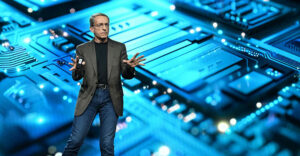

In sharp contrast, AMD, with its IBM-trained top executives Lisa Su and Mark Papermaster, put its efforts into strengthening AMD while Intel, its primary competitor, suffered through some now corrected leadership issues.

This allowed AMD to take extreme advantage of Intel’s period of weakness and while Intel remains stronger, AMD’s gains are unlikely to reverse unless it’s locked out of the Intel fab project — which doesn’t seem likely given the level of government funding going into that effort.

Approach

There is also a difference in approach between AMD and Intel. AMD is famous for its strategy of listening to customers and building what they want as opposed to Intel’s traditional strategy of convincing its customers they want what Intel built. To its credit, Intel has been pivoting to AMD’s far more customer-friendly practice.

Facebook’s CEO, however, is famous for effectively believing his customers are idiots (he reportedly used a far less acceptable term). Zuckerberg argues that he is much more mature now, but that seems to mean that he is more circumspect regarding sharing his opinions, not that those opinions have changed.

The bigger problem for Facebook is its revenue model which decouples users from the revenue stream and is funded instead by advertising. This decoupling goes back to the dotcom collapse in the late 1990s in which a lot of young executives misunderstood how business worked and played down fundamentals like customer care, loyalty, and making sure your revenue stream and development efforts were coupled.

When you decouple revenue from what you are doing, it can lead to rather large mistakes, like Facebook trying to develop a cryptocurrency or renaming itself Meta.

Since the money doesn’t seem connected to anything you are doing, the perception is that then you can do whatever you want. This approach clearly backfired badly against those old dotcom companies, and it’s backfiring against Facebook today.

You can argue that this decoupling model has been used successfully for decades. The television and radio industries also made their money from advertising while providing a “free” service. But recognize that TV and radio network ownership has changed a great deal over the years and is tightly regulated.

Plus, it has had decades to mature into something with third party metrics (Nielson Ratings) that tend to keep the networks and advertisers coupled with the content. Newly emerging networks are not advertising based. They live off subscriptions which, again, couple the revenue to the service, making them far easier to manage — not to mention a growing challenge to traditional, ad-based networks.

Wrapping Up

The difference between AMD’s success and Facebook’s growing failure is that AMD has a formally trained leadership team, its revenue model is coupled to its customers, and when its primary competitor stumbled, AMD took advantage of that competitive opportunity.

Facebook’s leadership isn’t experienced, and its leadership model is more like a king or emperor who has absolute power and serves for life. Its revenue is disconnected from its users, who their CEO appears to believe are mentally challenged, and the company appears to be looking desperately for a second act because it has little understanding of its current product.

AMD’s risks and challenges come from its strengthening competition and the evolution of the smartphone platform where it currently has no foot in the door. Facebook’s problems are largely self-created and are tied to a leader who is poorly trained and possesses little skill but can’t be replaced.

While most experienced CEOs know to avoid regulation because it results in reduced agility and increased costs, Zuckerberg arguably has been begging for it because he seems to think that government can run his company better than he can.

Trust me, as bad as Zuckerberg is, government intervention would be worse for Facebook.

Ironically, Facebook should be far easier to run than AMD because it doesn’t build a physical product and it dominates its market. In the end, this difference just shows there is nothing more valuable than focused experience when it comes to running a company.

If I were to advise Zuckerberg, I’d suggest he swallow his pride and take one or two years off, shadow several successful CEOs to watch how they approach their day, how they handle hiring and employee care, how they treat customers, and why they generally don’t decouple revenue from the folks that use their products.

Facebook is fixable. Zuckerberg should be working harder to remove himself from the top of the list of things that need to be fixed.

Rivian R1T Electric Pickup Truck

Tesla is an interesting company to watch because it shouldn’t have been successful. Electric cars were mostly a bad joke before Tesla. If it weren’t for Tesla, they’d still be a bad joke today. However, Tesla’s execution has left a lot to be desired. Its quality is almost laughably bad, the “self-driving” technology has been a death trap, and its CEO often seems just this side of crazy.

Still, it’s a model case of what can happen if you understand how to build demand through exclusivity, programmatically deal with unique problems (like charging), and generally treat your customers well. And, per the above, couple your revenue to your users.

But, aside from Tesla’s problems, we’ve been waiting for a better Tesla, and Rivian has the potential to be just that. Rivian doesn’t have its own charging network, but it arrives at a time when other networks have become viable, so it may not need one (still, that remains a Tesla advantage).

The initial run of the Rivian R1T, while limited, appears to be amazingly good for a first-generation product and of higher quality than what Tesla produces now. Rivian surpassed Tesla by going to individual wheel drive which is a superior technology to Tesla’s two-motor, all-wheel drive, as Rivian uses a motor for every wheel.

Rivian R1T electric pickup truck (Credit: Rivian)

Rivian started with a pickup truck which is arguably better for an electric vehicle than a four-door sedan because pickups tend to be working vehicles that typically aren’t driven long distances. Further, EVs, if properly configured, can power tools. Powering tools is a feature that pickup truck drivers tend to want, but sedan users don’t.

Like Tesla, Rivian has sold out well over a year in advance and probably won’t meet demand for at least two years. I’m not a pickup driver, but some of the Rivian’s unique features, like a pull-out grill, might convince me to buy one.

The only thing I don’t like is the headlights, which I expect will be corrected when the company facelifts the vehicle (though they don’t look that bad at night). The Rivian Forum has been all over this.

Rivian showcases that you can build a high-quality electric vehicle at an affordable price with amazing specs: zero to 60 in three seconds, more than 300-mile range, and a towing capacity of up to 11,000 lbs. That’s amazing, making the Rivian R1T my product of the week. I confess the R1S SUV is more my kind of ride, but it isn’t shipping yet.